Please enter latest Asset Allocation text

We all know – or rather, have heard of – Warren Buffet. One of his more famous mantras is: to get rich you need to be fearful when others are greedy, and greedy when others are fearful. Of course, this is much harder than it sounds, particularly over the long term. But it captures well how we have traversed asset markets in the short but tumultuous recent months, raising our appetite for risk near the March nadir, and then reversing back down to neutral at the end of June.

Risk appetite can be a loaded term. Put simply, it reflects expectations of how volatile assets might be rewarded, with high prospective returns per unit of risk associated with greater risk appetite, and vice versa.

Central banks responded by attempting to maintain market liquidity. As a result of all the pandemic financial support programs central banks’ balance sheets have grown – the European Central Bank (ECB) by €645 billion, and the US Federal Reserve’s by $2.3 trillion.1 Fed action sought to buy the “Fallen Angels” – bonds that were investment grade but whose credit ratings had been reduced to junk bond status – and high yield ETFs. There was also talk that the ECB might follow suit.

In March, as economies were buffeted by “sudden stops” in economic activity as countries were shut down to contain the spread of Covid-19, fear percolated the valuation of pretty much every asset class. Investment grade corporate bonds were compensating investors for 50 times the historical rate of defaults, for instance, while several equity indices were priced at or close to book value, stripped down to the realisable value of assets in liquidation. Yet at the same time, unprecedented global policy stimulus was released into credit and labour markets. We believed that although sharp recessions were likely – far greater than any experienced in post-war history – this would ultimately prove to be a temporary shock, with the US economy for instance regaining Q4-2019 levels by the end of 2022.

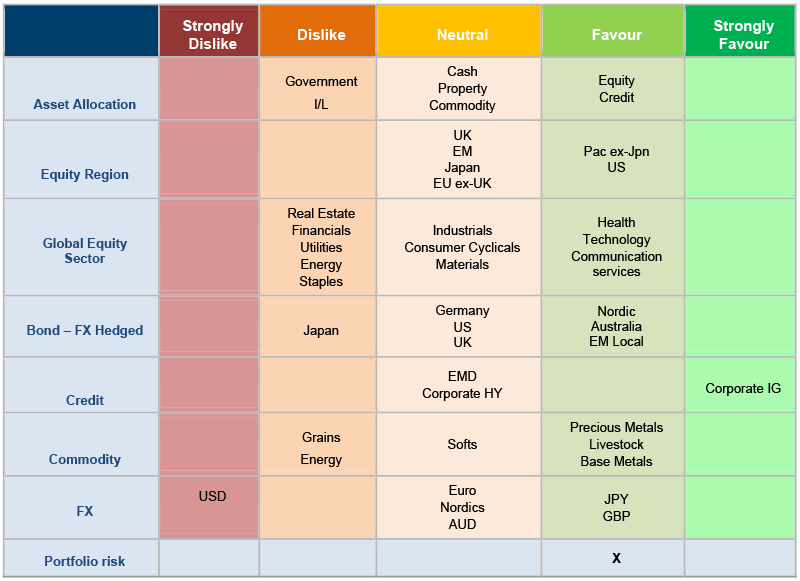

So in March and April we “leaned in” to the prospect of super-normal returns in select risk markets that seemed well placed to benefit. By investing in highly rated corporate bonds and raising and rotating our equity exposure towards the US and away from cyclical areas of Japan and the UK, we simultaneously raised both the quality and quantity of risk in total return multi-asset portfolios.

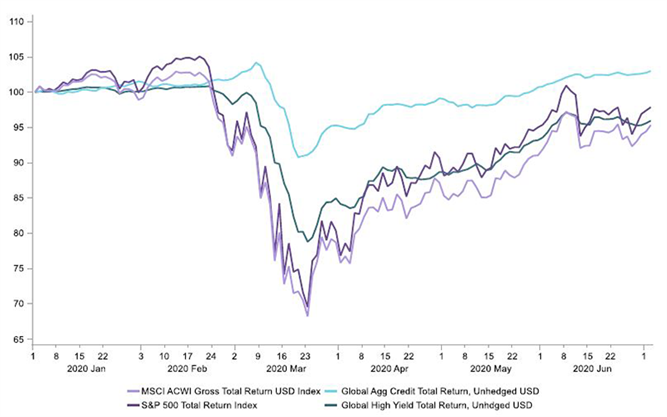

Fast forward to today, and the world feels different – taking some risk off the table feels prudent, hence our move to neutral. Equity markets and credit spreads have recouped much of what was lost in March, denting valuations (Figure 1). Expectations of reward, or asset returns, are necessarily lower than they were in March. And at the fringes, uncertainty is mounting – from second waves of the virus to trade tensions/Chinese geopolitics, US elections and how labour markets emerge once furlough and support schemes fade.

This move does not put us in a defensive mode; indeed, it leaves us quite exposed to both equity and credit risk that we continue to favour within overall risk neutrality. Policy easing continues to run at an extraordinary clip: China, Japan and Europe are among regions that are upping their games, and we expect a fresh dose of US fiscal stimulus to come through by late July-early August. Lower effective discount rates are a powerful support as economies recover and we are keen to be long assets that are most impacted, such as IG credit. As economies reset in early stages of recovery, higher equity multiples might also be expected.

Furthermore, although investor positions have been built from the March shakeout, there seems considerable room for further increases: allocations by non-bank investors to equities, for example, are still at the low end of the post-Lehman crisis period and below historical averages, with elevated offsetting cash balances.

Columbia Threadneedle Investments, 3 July 2020. The mention of any specific shares or bonds should not be taken as a recommendation to deal.